We've all heard the saying, "Cash is king!" And if that's true, that makes credit the queen of these lands. Credit is a powerful tool that lets you buy a home, a car, start a business, or take care of anything you wouldn't normally have the cash on hand for.

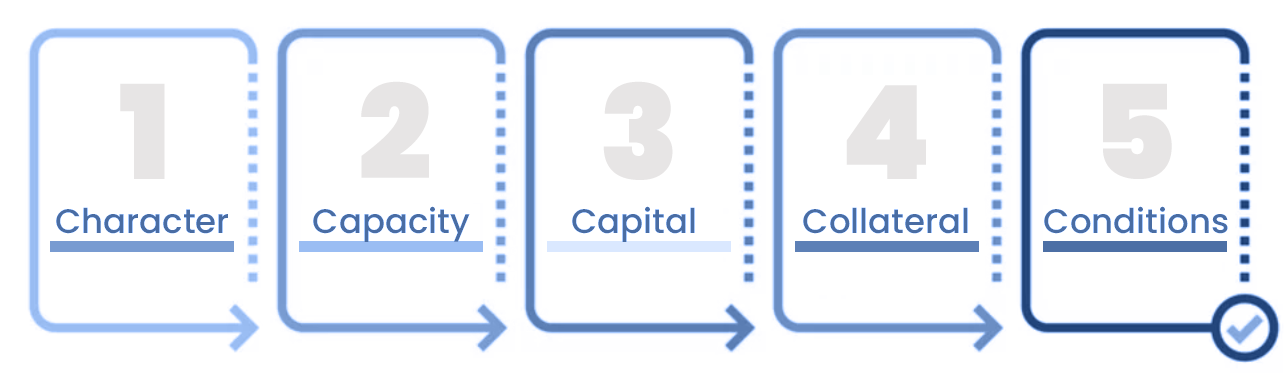

However, before you get credit, the lender needs to ascertain your creditworthiness to determine your ability to pay the loan back. That's where the five C's of credit come in. "What are the five C's of credit," you're asking yourself. They are character, capacity, capital, collateral and conditions.

In this article, we'll break down each of these characteristics you're judged upon, so that you can understand what hurts or helps your credit.

Admittedly, the first "C" should probably be for "credit report" which lenders use to determine whether you will and are able to repay your debt. Credit history starts to build whenever you open up credit cards or take out a loan for something like a house or car. Whenever you make payments (or don't), the lender can declare your history to the three major credit bureaus to build a detailed credit report.

The three major credit bureaus are Equifax, TransUnion, and Experian, and they typically report the last 7-10 years of your credit history. The information in these reports is used to build a credit score, which lenders use to gauge a person's trustworthiness - in other words, your "character". The two main firms responsible for calculating the score are Vantage and FICO. A low score can bar you from receiving the loan. That's why it's important to maintain a good credit history.

The second "C" stands for "capacity" which is used to determine your ability to repay the loan. To find your capacity, the lender will calculate your debt-to-income (DTI) ratio, which is a measure of how much money you make compared to how much you need to spend on debts. In most cases, they want to see a low DTI ratio around 35% or less. However, capacity isn't a make-or-break standard, but it does help in giving the lender confidence that can handle more debt and will repay your loan.

The third "C" refers to your "capital". Capital is whatever assets, properties, savings, and investments you put towards the purchase. For instance, you can put a down payment for a new car, and it will help you get lower interest rates and assure the lender you're serious and have the capacity to repay the loan.

The fourth "C" is for "collateral", and this is a security deposit (either cash or assets) given to the lender to secure the loan. They are sometimes called a "secured loan" or "secured debt." In the event you can't repay the loan, the lender will take the collateral to offset their losses. Collateral can also help you if your creditworthiness would otherwise disqualify you. Using collateral via secured loans and secured debt is a fantastic way to build or repair credit history.

Our fifth and final "C" is "conditions", and it's a catch-all term that refers to all other information the lender uses to determine if they will loan to you. This can be anything from your employment history and what you intend to use the money for to current market conditions such as interest rates and the general economy.

The five C's are important to keep at the forefront of your mind when building your credit and thinking about making a big purchase. It empowers lenders to judge your riskiness, but it also empowers you by giving you the confidence and information to make the best decision for your financial future.

We hope this article was of value to you. For more great tips, bookmark our site and for all your mortgage needs, visit Team Tina at TMFFMS.